Gold Road Resources (ASX:GOR) has announced an institutional share placement and accelerated 1-for-10 entitlement offer to raise up to $74 million. The funds raised will be used to purchase long lead time items for the Gruyere Gold Project; to commence early works and front end engineering and design on Gruyere; to provide flexibility to pursue open pit depth extensions at Gruyere and regional exploration; and for general working capital and corporate purposes.

Highlights

- Institutional placement to raise approximately A$43 million (Placement)

- Accelerated 1 for 10 non-renounceable entitlement offer to raise approximately A$31 million (Entitlement Offer)

- New shares to be issued at A$0.44 per share (Offer Price), representing a 4.3% discount to last close of A$0.46 as at 26 April 2016

- Three high quality North American institutional investors have entered into binding agreements to subscribe for A$20 million as part of the Equity Raising

- Use of proceeds include the purchase of long lead time capital items, commencement of early works and FEED, flexibility to fund possible Gruyere Project open pit depth extensions as well as regional exploration programs

Overview

Gold Road Resources Limited (Gold Road or the Company) is pleased to announce the launch of an institutional placement and a 1 for 10 pro-rata accelerated non-renounceable entitlement offer to raise approximately A$74 million (Equity Raising).

Gold Road is currently fully funded with existing cash on hand to complete the Feasibility Study (FS). Funds raised via the Equity Raising will be used to:

- Purchase long lead time capital items

- Commence early works and front end engineering and design (FEED)

- Provide flexibility to fund possible Gruyere open pit depth extensions as well as regional exploration programs at priority targets across the Yamarna Greenstone Belt

- General working capital and corporate purposes

By raising this capital now the Gruyere Project execution plan is further de-risked and de-bottlenecked allowing for a smoother development schedule.

Gold Road is committed to delivering Australia’s next large scale gold project with the development of the Gruyere Project. The Board of Directors approved the commencement of a FS following the release of its positive Pre-Feasibility Study on the 8 February 2016, which paves the way for completion of the FS in late 2016, commencement of construction in early 2017 and first gold production in late 2018. The Gruyere Project is set to be a large scale, open pit operation utilising a conventional 7.5 Mtpa gravity/carbon‐in‐leach plant for an initial project life of 12 years.

Gold Road’s Executive Chairman Ian Murray commented, “This Equity Raising follows the release of the detailed Pre‐Feasibility Study confirming the Gruyere Project as one of Australia’s best undeveloped gold deposits, with a long life and low costs. The findings indicate a technically sound and financially viable project, which is anticipated to support strong margins and cash flow. The decision to raise additional equity now is a strong signal of Gold Road’s commitment to developing the Gruyere Project. It also highlights significant investor interest in supporting Gold Road in this endeavour. This Equity Raising will enable Gold Road to de-risk and to de-bottleneck the Gruyere Project, and to expedite its development, through the purchase of long lead time capital items and commencement of early works and FEED, in parallel with the completion of the Feasibility Study and a continued focus on exploiting priority exploration targets across the Yamarna Greenstone Belt”.

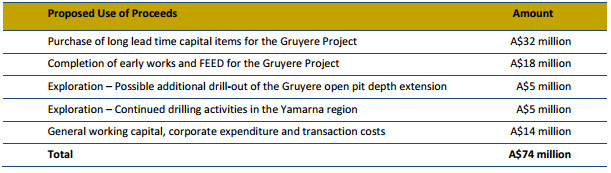

Use of Proceeds

The A$74 million gross proceeds from the Equity Raising will be applied to fund the following:

Equity Raising

Gold Road is undertaking a A$74 million Equity Raising at an Offer Price of A$0.44 per share, which represents (as at ASX market close on Tuesday, 26 April 2016) a:

- 3.5% discount to TERP(1) of A$0.456

- 4.3% discount to the last closing price of A$0.460

- 10.7% discount to the 5 day VWAP of A$0.493

The Equity Raising is comprised of:

- the Placement of approximately 98 million new shares to sophisticated and institutional investors at the Offer Price of A$0.44 per new share (New Shares), to raise approximately A$43 million; and

- the Entitlement Offer to raise approximately A$31 million at the Offer Price comprised of:

- an accelerated institutional entitlement offer (Institutional Entitlement Offer); and

- a retail entitlement offer (Retail Entitlement Offer).

New Shares will rank pari passu with existing shares on issue.

(1) The Theoretical Ex-Rights Price (TERP) is the theoretical price at which Gold Road shares should trade immediately after the ex-date for the Entitlement Offer. TERP is a theoretical calculation only and the actual price at which shares trade immediately after the ex-date for the entitlement offer will depend on many factors and may not equate to TERP. The TERP includes New Shares to be issued under the Placement.

Placement and Institutional Entitlement Offer

Eligible institutional shareholders with registered addresses in the offering jurisdictions will be invited to participate in the Institutional Placement and Institutional Entitlement Offer, which is being conducted from Wednesday, 27 April 2016 to Thursday, 28 April 2016. Eligible shareholders can choose to take up all, part or none of their entitlement. As the Entitlement Offer is non-renounceable entitlements cannot be traded.

Together with the Placement, institutional entitlements that eligible institutional shareholders do not take up by the close of the Institutional Entitlement Offer, and institutional entitlements that would otherwise have been offered to ineligible institutional shareholders, will be offered to Eligible Institutional Shareholders who apply for New Shares in excess of their entitlement, as well as to certain other eligible institutional investors.

Importantly, Gold Road has secured three additional quality North American institutions who have entered into binding agreements to subscribe for A$20 million of the Equity Raising at the Offer Price. These institutions add to the quality and depth of Gold Road’s share register.

Retail Entitlement Offer

Eligible retail shareholders with retail addresses in Australia and New Zealand will be invited to participate in the Retail Entitlement Offer at the same Offer Price as the Placement and Institutional Entitlement Offer. The Retail Entitlement Offer is underwritten by Macquarie Capital (Australia) Limited. The Retail Entitlement Offer will open from 7.00am (AWST) on Tuesday, 3 May 2016 and close at 3.00pm (AWST) on Monday, 16 May 2016. Applications will not be accepted for additional New Shares in excess of an eligible retail shareholders’ entitlement.

Further information will be sent to Eligible Retail Shareholders in a booklet (Retail Offer Booklet) expected to be lodged with ASX and despatched on or around Tuesday, 3 May 2016. The Retail Offer Booklet and the accompanying personalised entitlement and acceptance form (Application Form) will contain instructions on how to apply. Application Forms and payments are due by no later than 3.00pm (AWST) on Monday, 16 May 2016.

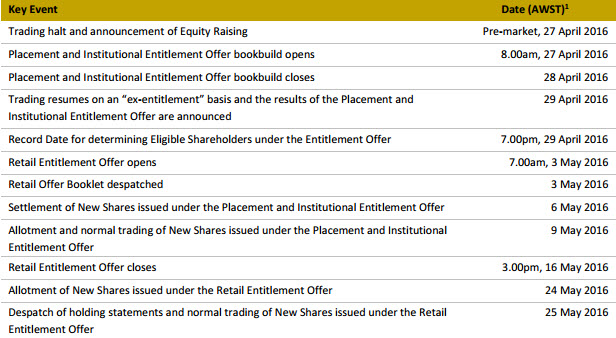

Key Dates

Notes: (1) All times are Perth time unless specified. The above timetable is indicative only and subject to change. Gold Road, in conjunction with the Joint Lead Managers, reserves the right to amend any or all of these events, dates and times subject to the Corporations Act 2001 (Cth), the ASX Listing Rules and other applicable laws.

Additional information

Additional information regarding the Equity Raising is contained in the investor presentation released to the ASX today. The Retail Offer Booklet will be released separately and mailed to eligible retail shareholders.

Nothing contained in this announcement constitutes investment, legal, tax or other advice. You should seek appropriate professional advice before making any investment decision.

Gold Road has appointed Macquarie Capital (Australia) Limited and Argonaut Securities Pty Ltd as Joint Lead Managers to the Equity Raising.

Treadstone Resource Partners acted as strategic and financial adviser and Corrs Chambers Westgarth acted as legal adviser to the Company.