Gold Road Resources (ASX:GOR) has provided an update on the Feasibility Study on its Gruyere Gold Project, 200 kilometres east of Laverton in Western Australia, stating that all technical work was complete and the study remains on schedule for completion by the end of 2016. Work completed to date includes the finalisation of geotechnical parameters guding the design parameters for the Gruyere open pit.

Highlights

- Technical work for Feasibility Study complete

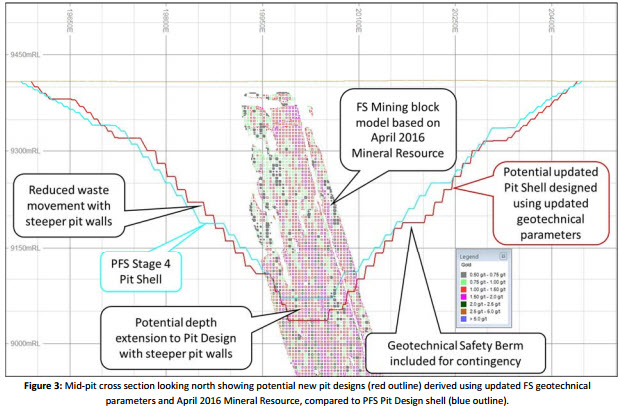

- Updated geotechnical parameters steepen pit slope angles by 3 to 5 degrees on average, allowing for both potentially deeper pits and lower strip ratios

- Capital and operating cost estimates being finalised

- Power supply contract tenders, gas vs diesel options, being reviewed

- Detailed engineering for early works program underway

- Project Funding progressing with banks shortlisted

- Feasibility Study on track for completion as scheduled in December 2016 quarter

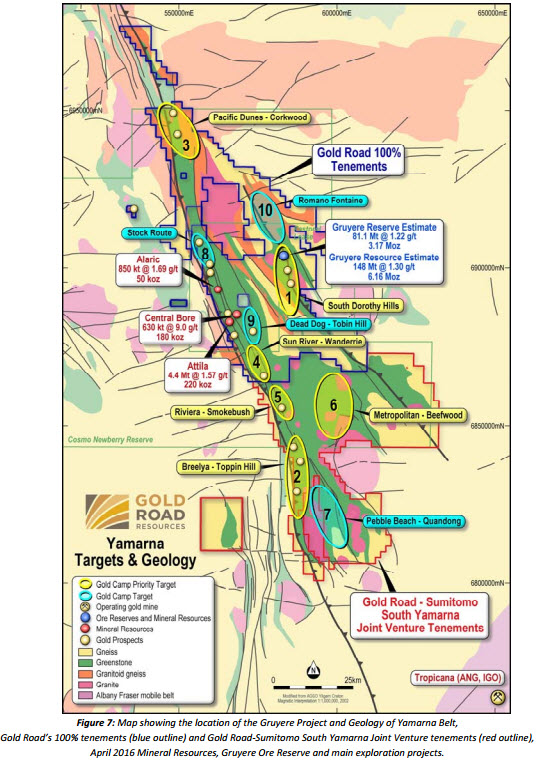

Gold Road Resources Limited (Gold Road or the Company) is pleased to provide an update on the Feasibility Study (FS) currently underway on its Gruyere Project, 200 kilometres east of Laverton in Western Australia. The FS remains on schedule for completion in the December 2016 quarter. Development of the Gruyere Project, one of Australia’s best undeveloped gold deposits, offers Gold Road the opportunity to transition from explorer to a mid‐tier Australian gold producer.

Ongoing FS work has added considerable detail to technical, permitting, and financial aspects of the Pre‐Feasibility Study (PFS) (ASX announcement dated 8 February 2016). Detailed analysis and evaluation of the current information will form the basis of the completed FS on which a decision to develop the Gruyere Project will be based.

Gold Road Managing Director and CEO Ian Murray said: “We are pleased with the progress to date on the Feasibility Study which, once completed, will form the basis of a final investment decision. The progress of technical works, which have been completed on schedule and to a high quality, allowing commencement of the early engineering design work, is testament to the continued dedication and focus of our Owner’s Team and consultants who have again delivered as expected. The quality of work provides additional de‐risking of the Gruyere Project as a whole, which adds the extra confidence required for such a significant development, the first upon the Yamarna Belt. We believe this has enhanced Gruyere’s status as one of the best and largest undeveloped gold projects in Australia. We look forward to delivering a positive Feasibility Study within our planned schedule and moving Gruyere through to development”.

Work completed to date includes finalisation of geotechnical parameters guiding the design criteria for the Gruyere open pit. The new parameters, based on an updated geotechnical study incorporating more than 3,000 metres of new diamond drilling, has allowed the final pit wall slopes to be steepened by an average of 3 to 5 degrees, resulting in optimised pit designs with increased depth and lower strip ratios compared to the PFS. Final mining inventories will be reported on completion of the FS.

As communicated to the market as part of the A$74 million capital raising in May 2016, implementation of the early works strategy has commenced, which will further de‐risk the Gruyere Project. Conditional contract packages for process plant EPC, early works engineering, SAG and ball mills, primary crusher, gas pipeline, construction of the first phase accommodation village and installation of the communication infrastructure backbone, are expected to be awarded over the coming months as part of this strategy.

Gold Road has also made significant progress with respect to the required regulatory approvals. An historic native title mining agreement was signed with the Yilka People and the Cosmo Newberry Aboriginal Corporation covering Gruyere and the nearby Central Bore deposits in May 2016. This was followed shortly after by the granting of the mining leases for the Gruyere Project, and the satellite Central Bore and Attila‐Alaric deposits.

The Company gained certainty around the level of environmental assessment required, with the Environmental Protection Authority advising in June 2016 that it will assess the Gruyere Project as “Assessment on Proponent Information Category A (API‐A)”. The draft API‐A document is now being prepared for submission in the September 2016 quarter.

Gold Road has also submitted the EPA Referral for construction of the proposed pipeline that will supply gas to power the Gruyere process plant and village. The EPA advised that the level of assessment for the pipeline project is “Not Assessed” meaning clearance approvals for pipeline construction will be assessed by the Department of Mines and Petroleum only. This provides a simplified approvals process which has potential to deliver cost and time savings to Gold Road.

Feasibility Study Progress

Study Parameters

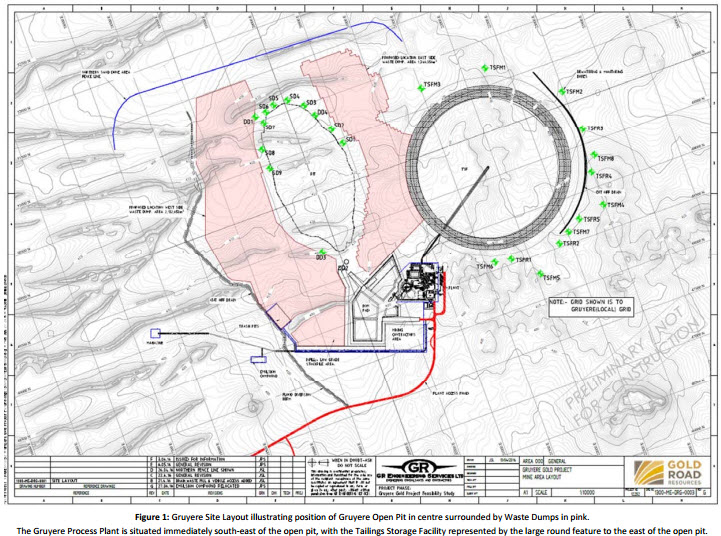

The FS parameters are essentially unchanged from the PFS and remain based on the following key parameters, with overall site layout illustrated in Figure 1:

- April 2016 JORC Code 2012 compliant Gruyere Mineral Resource update of 147.7 Mt at 1.30 g/t Au, which equates to 6.16 Moz of gold at a cut‐off grade of 0.5 g/t and constrained within a A$1,700 per ounce optimised pit shell (ASX announcement dated 22 April 2016). The key change from the PFS is a 10‐fold increase in the Measured Resource from 1.4 million tonnes to 14 million tonnes

- Single open pit to be mined in four stages based on a final optimised pit shell using a A$1,500 per ounce gold price. This compares to a A$1,400 per ounce shell used in the PFS

- Open pit earthmoving mining operations conducted by contractors

- Processing plant and infrastructure built under Engineering, Procurement and Construction (EPC) contracts and Owner operated/managed

- Water supplied from two local borefields accessing palaeochannel‐hosted water resources

- Power supply under a Build‐Own‐Operate contract for a gas‐fired power generation plant with the fuel supplied by gas pipeline

- Road access via a network of established sealed and unsealed roads, with addition of a site access road (25 kilometres) to be constructed

- FIFO workforce flying direct from Perth to the Gruyere Project site.

Technical Studies Update

Mineral Resource Update – April 2016

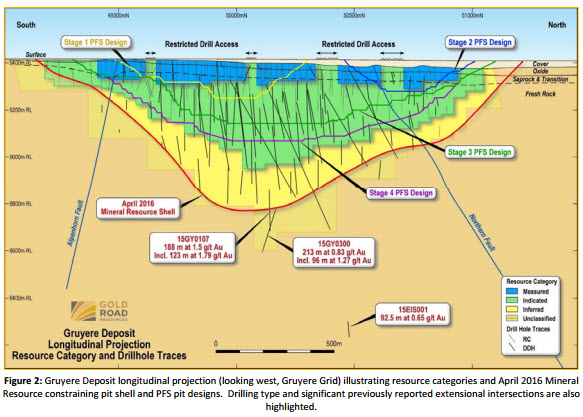

The Mineral Resource was updated for the FS and reported in April 2016 (ASX announcement dated 22 April 2016). The updated Mineral Resource now totals 147.71 million tonnes at 1.30 g/t Au for a total of 6.16 million ounces of gold, which represents a 15% increase in tonnes, a 5% decrease in grade and a 10% increase in metal compared to the previous Mineral Resource used in the PFS. The updated Mineral Resource includes 13.86 million tonnes at 1.18 g/t Au for 0.53 million ounces in the Measured resource category, which represents 9% of the total resource metal, and is located in the upper 100 metres of the deposit (Figure 2) which would be available during the early years of mine development, and importantly for conversion to a significantly increased Proven Reserve in the FS. The updated Ore Reserve will be published on completion of the FS in the December 2016 quarter.

Geotechnical Study Update

The FS level geotechnical study has been completed by consultants Dempers and Seymour, with additional review by third party geotechnical experts retained by Gold Road. The study incorporated additional data derived from drilling and testwork completed since the PFS. This new data includes 13 new geotechnical diamond holes (3,232 metres) to complement the information available during the PFS, providing information in the deeper areas of the PFS final pit, and in areas allowing potential expansion of that pit. The improved database allowed more detailed analysis of rock mass characteristics in both the near surface oxide and deeper fresh rock zones, and extended the knowledge of a major fault zone in the western footwall of the mineralisation which affects the final pit designs. The improved knowledge and understanding of the rock mass behaviour has allowed the design of steeper overall pit slopes compared to the PFS, with associated potential to improve the economics and mine life of the Gruyere Project.

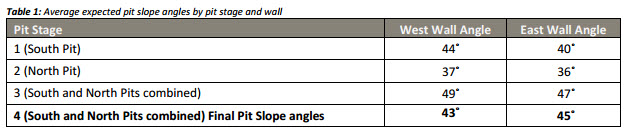

In general, FS final slope angles are expected to be approximately 3 to 5 degrees steeper compared to PFS which had a final pit slope angle of 40 degrees. Approximate overall slope angles achieved when applying the new parameters to the PFS Pit Stages are highlighted below (Table 1). The slopes in the Stage 1 to 3 pits vary based on depth of weathering with the early shallower pits requiring shallower angles, and interim steeper walls in the Stage 3 Pit. Slope angles in the final Stage 4 design flatten out to accommodate the final permanent walls which require stability to end of mine life, to allow for an identified fault zone on the west side of the ore body, and include contingency for a geotechnical safety berm. This safety berm will be incorporated into the FS but will in reality only be added if the pit wall conditions required its inclusion at the time.

Mining Study

Mining studies remain in progress, incorporating the updated Mineral Resource, new geotechnical design criteria, revised mining and processing assumptions, and updated processing and mining cost inputs into the optimisation and mine design. This is the final major technical aspect of the FS to be completed. Initial results of optimisation works indicate that depth extensions to the PFS final pit design are possible due to the steepening of the walls allowed by the new geotechnical information. Figure 3 shows a modified pit design configuration which results in a slightly deeper pit shell (30 to 50 metres deeper) with potential for less waste movement. This provides options to both increase the ore available while decreasing strip ratios.

The pit design work and final mining schedules, including staging approaches and stockpiling strategies, are ongoing. This is a vital area of the study which has significant scope to add incremental value.

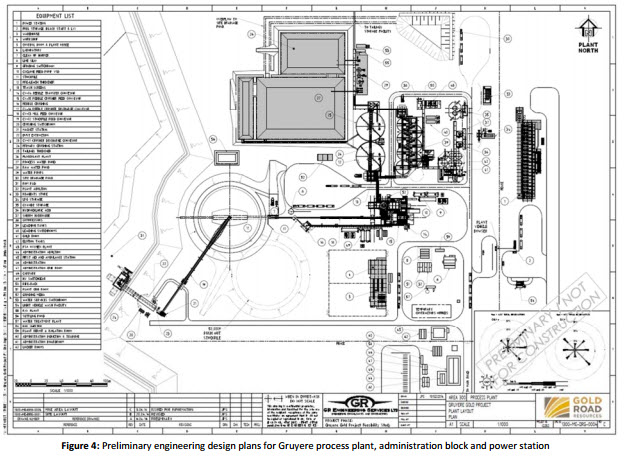

Process Plant and Early Engineering

The FS design plant layout for the Process Plant is complete (Figure 4), with no significant deviation from the PFS design. The flow sheet remains as a single stage crush in to a SABC circuit, with gravity and CIL gold extraction. The mill throughput rate remains annualised at 7.5 Mtpa for fresh rock, with capacity for 8.0 to 8.8 Mtpa for transition and oxide ore feed. There are no major changes considered in the FS design.

The Company has commenced the technical and commercial evaluation for the procurement of the SAG and ball mills, and primary crusher. It is planned to have conditional orders placed on these three critical long lead items in the December 2016 quarter.

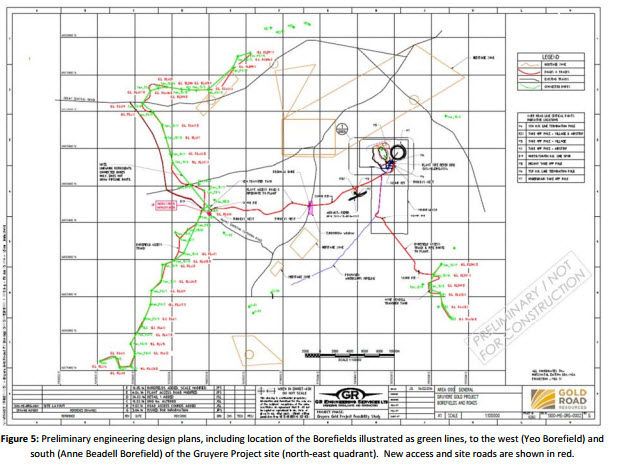

Water Supply

The Gruyere Project design incorporates two borefields (Figure 5) to supply process water (Yeo Borefield) for the process plant, and potable water (Anne Beadell Borefield) for construction, the accommodation village, and other purposes including the elution circuit in the process plant.

The Anne Beadell Borefield, approximately 21 kilometres south‐east of the process plant site, will consist of six water bores (four duty and two standby) accessing a brackish water source. This water will be processed through a Reverse Osmosis plant. The design of this borefield and Reverse Osmosis plant is a critical item of focus in the early works engineering programme to ensure appropriate water quality is available for the initial earthworks and construction aspects of the Gruyere Project. The detailed engineering is in progress with a view to including this for early works contract packages.

The Yeo Borefield, approximately 25 kilometres west of the process plant, extends for a length of 80 kilometres, compared to 65 kilometres in the PFS, and will abstract saline water from the Yeo Palaeochannel as the main source for process water. This is one aspect of the Gruyere Project that has had a material design change compared to the PFS to meet EPA requirements.

The borefield pipeline, powerlines and associated access tracks has been lengthened in design as part of environmental adaptive management controls required to comply with Gruyere Project permitting conditions. Specifically, there are areas of the Yeo Palaeochannel environment which host endemic species of Subterranean Fauna (Stygofauna). These Stygofauna, require controlled management of the water drawdown in the vicinity of their habitat. Twenty‐two of the planned 32 production bores (23 duty and 9 standby) have been constructed, however 10 of the bores have been provisionally removed from the operating roster pending the results of ongoing stygofauna investigations. A further 20 production bores have been planned as part of the construction phase. This necessitated changes to the PFS borefield design which has added approximately eight kilometres to the length of the borefield infrastructure (pipework, powerlines and access track), with an associated likely increased cost.

Power Supply

The PFS recommended a 40 MW gas‐fired power generation plant with fuel delivered by a gas lateral pipeline from the Eastern Goldfields Pipeline. The identified pipeline route will start from the existing pipelines in the Laverton area and will follow the White Cliffs Road to Gruyere, a distance of approximately 220 kilometres. Gold Road has submitted Miscellaneous Licence applications covering the entire route and is currently negotiating required access with existing exploration and mining title holders, with discussions near complete.

Gold Road issued requests for tender for a Build‐Own‐Operate solution for the power supply for the Gruyere Project in March 2016. Tenders have been received from a number of parties for gas‐only, diesel only and diesel start‐up converting to gas‐fired options. All tender pricing structures were in line with the PFS power cost assumptions, providing the confidence required for the FS financial analysis. The Company is progressing the tender process with the aim of finalising in the September 2016 quarter, which will allow the successful party to commence their own early works programmes.

Renewable energy options will continue to be evaluated, in parallel to the conventional gas‐diesel options, during the FS and into construction to identify the potential for economic improvements associated with alternative power sources. Gold Road considers the opportunity to convert part of the power supply to clean energy options in the future as a critical strategic driver for a project such as Gruyere which has a long mine life.

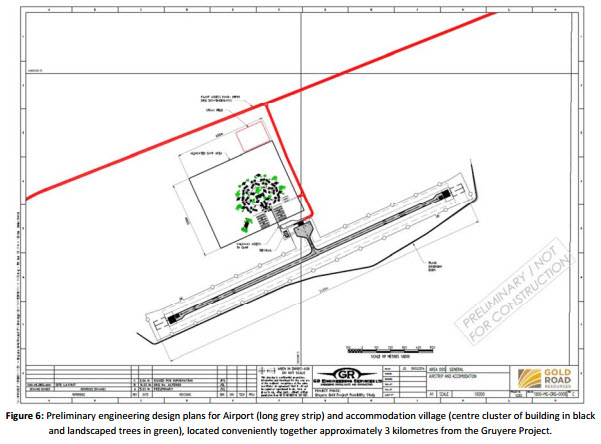

Airport and Accommodation Village

The airport and accommodation village locations and designs have been finalised (Figure 6) and tenders drafted. The Company has altered the scope from the PFS to increase the construction accommodation village from 500 to 600 man capacity, with a potential increase in capital cost. Gold Road is currently investigating options for purchase of good quality secondhand camps to reduce the capital cost requirements. It is planned to locate the accommodation village within walking distance of the airport to allow easy and convenient access for site personnel during their commute, and remove the requirement for bus transfers to and from the airport.

Project Funding

Gold Road continues exploring various funding mechanisms and structures for the Gruyere Project. Decisions on Project funding will be made on completion of the FS and after the Company has had the opportunity to assess the merits of all options to determine the appropriate funding structure.

Potential funding options being considered include:

Project Finance

The Company is investigating traditional debt and equity structures as a base case for project development. The Project Finance work commenced in March 2016 and preliminary discussions have been held with a number of local and international banking groups. These have been short listed, based on indicative terms, to a limited number of preferred banks to take through the final stages of the Project Finance negotiations.

Joint Venture

Gold Road invited a small number of international and domestic mining companies to consider joint venture options for the Gruyere Project. A number of indicative, incomplete and non‐binding proposals were received and assessed. The Company has not made any decision in relation to these proposals and will continue to consider this option alongside the Company’s various funding options.

The Company has retained Treadstone Resource Partners to act as its Strategic and Financial Advisor with respect to potential funding options and joint venture arrangements, and PCF Capital to act as its Financial Advisor with respect to the traditional project finance work stream.

Further Work

The following contract packages have been issued for tender or are in progress of being drafted for release later in 2016:

- EPC contract for the Gruyere process plant and associated infrastructure – issued in July 2016

- Bulk earthworks contract for roads, infrastructure, borefields, and airstrip construction – in draft

- Communication backbone infrastructure – in draft

- Accommodation village construction – in draft.

Key items of the FS in progress for completion include:

- Finalisation of Mining Study

- Finalisation of the capital and operating cost estimates financial analysis

- FS report document drafting

- Project Finance

- Ore Reserve Update.

Key milestones anticipated over the next two quarters include:

- September 2016 quarter ‐ deposits to secure the purchase of long lead‐time capital items

- September 2016 quarter ‐ preliminary award of gas pipeline early works design and long lead items

- December 2016 quarter ‐ completion of the FS

- December 2016 quarter ‐ finalise Project Finance package.