Australian heavy rare earths developer, Northern Minerals Limited (ASX: NTU) has commissioned a research report by independent consultancy Adamas Intelligence, focussing on dysprosium and the global drivers of supply and demand for the critical element. The report highlights the pervasive global use of dysprosium in today’s electronic driven lifestyles and how there are limited options for supply growth in the short term.

- 98% of global dysprosium production comes from China;

- Increased EV production is driving demand growth, even including efficiency gains;

- Chinese dysprosium production has decreased 34% since 2013 following crackdown on illegal miners;

- Browns Range is the only advanced dysprosium project globally that can address the supply gap.

Australian heavy rare earths developer, Northern Minerals Limited (ASX: NTU) (the Company) has commissioned a research report by independent consultancy Adamas Intelligence (Adamas) focussing on dysprosium and the global drivers of supply and demand for this critical element.

As Northern Minerals’ Browns Range heavy rare earth project enters the commissioning phase (see ASX announcement 24 April 2018), this report highlights the pervasive global use of dysprosium in today’s electronic driven lifestyles and how there are limited options for supply growth in the short term.

The full Adamas Intelligence report is available for download from the Northern Minerals’ website under Investor Centre, Analyst Reports and 2018 titled Adamas Intelligence – Spotlight on Dysprosium – April 2018.

Key Findings

Key findings of the Adamas report include:

- Dysprosium demand growth will be increasingly driven by global megatrends linked to electric mobility, clean energy, energy efficiency, and automation. These fast-growing policy-driven sectors will propel global dysprosium demand to new heights, requiring an unprecedented increase in global production to keep up.

- Over the past decade, China has been responsible for over 98% of global dysprosium oxide (or oxide equivalent) production each year. From 2005 through 2013 more than half of China’s dysprosium oxide (or oxide equivalent) production each year was derived from unsanctioned/illegal mining activities. An ongoing government-led crackdown on illegal rare earth mining in China has led to a 34% reduction in global dysprosium oxide production since 2013.

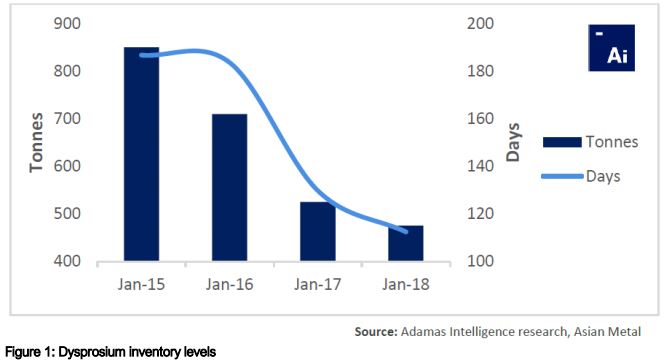

- Inventory levels have decreased markedly since 2015, with an almost 50% drop in held stocks to a low of ~110 days at the start of 2018 (Figure 1).

- · Adamas believes that China’s production alone will be insufficient to support global demand growth. In fact, by 2025 China’s demand for dysprosium oxide for electric vehicle traction motors alone will amount to 70% of the nation’s current legal production level, emphasizing the imminent need for new supplies. Outside of China, there are a handful of advanced rare earth development projects with potential to add significant quantities of dysprosium oxide production annually by 2025.

- If automakers, motor manufacturers, and other end-users of high-temperature NdFeB do not act today to secure long-term supplies, they will soon find themselves amidst a sellers’ market scrambling for rare earth motor metals the same way many are scrambling today for battery metals.