Lithium-ion batteries dominate the current critical minerals conversation. Miners need to meet demand and battery makers need to innovate to make batteries smaller, faster-charging, and with more storage.

One key challenge for battery makers, policy makers and mine site operators not yet addressed by current lithium-ion battery technology is the storage of renewable energy for extended periods of time.

According to Australian Vanadium (ASX: AVL), vanadium redox flow batteries may hold the key to long-term storage and the full transition to renewable power.

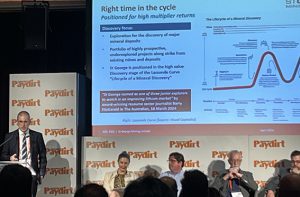

Managing director Vincent Algar told delegates on day 1 at the Paydirt Battery Minerals Conference that vanadium batteries have grid storage capabilities, and can handle high baseloads with very low reaction time. He said that the batteries could hold the key for operators already using renewables to, “bridge the gap between 80% to 100% renewable energy”.

“We are trying to fix an important problem, how do we get to net zero on mine sites that rely on diesel?” he said.

“It [the price] will move because of two reasons – it is a critical mineral and there is a shortage of supply.”

Following a $49 million grant from the Federal Government, as a part of the Collaboration Stream of the Modern Manufacturing Initiative, Australian Vanadium this morning released its bankable feasibility study (BFS) for the development of its high-grade vanadium mine in Meekathara, WA and processing plant at Tenindewa near Geraldton.

The initial 25-year mine life is targeting an average annual vanadium production of 7Mlbs vanadium (11,200t) as a 99.5% vanadium high purity flake and 900,000 dry tonnes per annum of FeTi co-product.

“BFS delivered this morning showing the product is robust and strong at the current price of $12 per pound. This is important stuff in terms of value,” Mr Algar said.