Magnetite Mines Limited (ASX: MGT) is undertaking a three-for-11 renounceable rights issue at $0.30 per share to raise up to $6.2 million before costs.

For every two new shares subscribed under the rights issue, eligible shareholders will receive one free attaching option with an exercise price of $0.45 and expiring 18 months from issue date. The issue price under the rights issue represents a discount of:

- 25.9% to the company’s last closing price of $0.405 per share; and

- 22.4% to the company’s 15-day VWAP of $0.386 per share.

The rights issue is underwritten to $3 million by lead manager Mahe Capital.

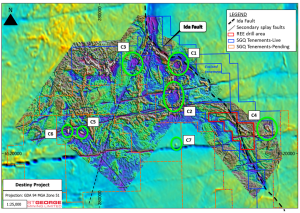

Funds raised (net of costs) will be used to finalise and lodge the Mining Lease Proposal for the Razorback iron ore project in South Australia and support the advancement of value engineering work, among other things.

Commenting on the rights issue, non-executive chairman Jim McKerlie said:

“The decision to optimise the size of the Razorback Project to at least 5 million tonnes per year output is proving to be the right one given the new global economic and market conditions. The forecast demand for DR-grade iron ore far outweighs the anticipated supply as the steel industry strives to reach its decarbonisation targets.

“The work that has been undertaken at Razorback indicates a project value in multiples of our current market cap and the board believes that this represents an excellent opportunity for shareholders. The board appreciates it has not been happy times for shareholders recently but we want to assure you that the value creation in the underlying project has been significant and we need to complete the feasibility studies to realise the full value of your company.

“This capital raise is prudent in terms of capital management and gives all shareholders an opportunity to take shares at an attractive price with a generous option included.

“All directors, the CEO and CFO are participating in the offer. We all believe in this project and are using all of our experience to ensure project success.”