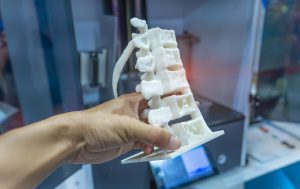

Singapore-founded regenerative medicine company Osteopore Limited (ASX:OSX or the Company) – a global leader in 3D-printed biomimetic and bioresorbable implants is pleased to announce the successful completion of its Renounceable Pro-Rata Entitlement Offer and Shortfall Offer to raise ~A$3,000,000 (before costs) (Entitlement Offer) which closed on 2 April 2024.

The issuance of New Shares and New Options under the Entitlement Offer and the Shortfall Offer will occur on 8 May 2024, with normal trading of the New Shares expected to commence on 9 May 2024. The New Shares will rank equally with existing ordinary shares on issue.

The Company entered into a mandate with Advance Capital Partners Pte Ltd (Advance Capital) in connection with fund raising and general corporate advisory activities (the Mandate). In connection with the Mandate, Advance Capital will be entitled to a fee of 3% of the subscription amount from the Entitlement Offer.

Funds raised via the Entitlement Offer will strengthen Osteopore’s balance sheet and maintain sales momentum while supporting the Company to develop breakthrough products, secure market approvals, acquire complementary technologies, explore mergers and acquisition (M&A) opportunities and increase working capital.

Osteopore continues to work towards developing the optimal conditions for revenue growth, whilst exploring different ways to improve the performance of our cost centres and streamline our expenses, with the effects of this starting to kick in over Q1 CY 2024.

In Q1 CY24, the Company achieved its 5th straight quarter of uninterrupted revenue growth, which saw revenues peak at 76% Year-on-Year (YoY) and 15% Quarter-on-Quarter (QoQ).

The Company wishes to thank its shareholders who participated in the Entitlement Offer for their ongoing commitment and dedication to Osteopore.