In an environment where all project developers are facing serious constraints in terms of construction, accommodation and labour, having three existing mines with resources and two processing plants able to be re-commissioned can only be a strategic advantage.

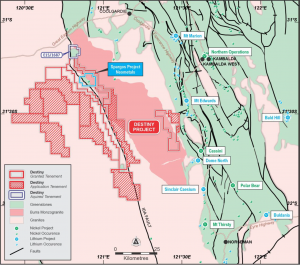

Poseidon Nickel Ltd has 420,000 tonnes of established nickel resources at the Black Swan and Mt Windarra projects north of Kalgoorlie, and Lake Johnston project near Norseman.

The company also has two established nickel concentrators at Black Swan and Lake Johnston, both currently on care-and-maintenance, but able to be recommissioned with a relatively short lead time and a minimal amount of capital.

Poseidon CEO Craig Jones told the final session of Paydirt’s Australian Nickel Conference that the company released the feasibility study back in November 2022 for a restart of Black Swan to produce a smelter grade concentrate.

“We are looking to get into production at Black Swan as a primary focus, but we also have other pillars of our vision around exploration and M&A activities,” Mr Jones said.

A decision was taken in July to defer the restart process while the company sought to further understand the non-sulphide nickel content through additional drilling and metallurgical testing to maximise recovery – about half the material is talc-carbonate.

“The benefit of doing that is we can potentially double our mine life and double our production, so there is a big prize in that for us if we can get that one to work,” Mr Jones said.

“We did some drilling in January last year to increase the confidence within the pit, so some success came out of there as well – where we managed a 48 per cent increase in the measured and indicated [resources] within the pit and we saw an increase in the grades.

“We also saw an increase in the non-sulphide nickel content as well, so with all the RC drilling and all the fines and products what we think was happening was a bit of oxidation in the fines as well.”

Mr Jones said it was important to better understand what the orebody was doing and how it would relate to achieving a concentrate specification for smelting. He said all of that test work was currently at the lab.

“So, since November last year we have been doing a lot of work technically to get this project ready – I keep mentioning it, but you must understand the orebody to really understand what you are doing.”