Financial technology company Stargroup Limited (ASX:STL) has significantly expanded its Australian Automatic Teller Machine netowrk through the $4.54 million acquisition of the CashmyATM business. CashmyATM’s assets include 97 ATMs throughout New South Wales, Queensland, Northern Territory, Tasmania and Victoria. As part of the transaction, CashmyATM founder and CEO Jason Warren has agreed to join Stargroup as National Business Development Manager.

HIGHLIGHTS

- Stargroup to expand ATM network to 365 machines with acquisition of a 97 ATM machine network from CashmyATM.

- Consideration is $4.54 million, 10% to be paid in STL shares above market at $0.05 (escrowed for 12 months) and balance in cash.

- Acquisition to be funded via a $3 million private placement which has been completed and a $3 million rights issue.

- Projected annualised revenue for expanded ATM network for FY17 to increase from $9.3 million to $11.4 million.

- Projected EBITA for FY17 to increase from $3.3 million to $4.3 million.

- Experienced ATM entrepreneur, Mr Jason Warren, to join Stargroup asNational Business Development Manager.

- Completion with effect from 1 June 2016.

BACKGROUND

Financial technology company Stargroup Limited (ASX: STL) has significantly expanded its Australian Automatic Teller Machine (ATM) network through the acquisition, via its wholly-owned subsidiary, Star Payment Systems Pty Ltd, of a 97 ATM network and associated business assets, including the CashmyATM brand, from Mr Jason Warren, trading as CashmyATM (CashmyATM).

On completion, Mr Jason Warren, an experienced entrepreneur and currently the CashmyATM CEO, has agreed to join Stargroup as its National Business Development Manager.

The ATMs to be acquired are deployed in New South Wales, Queensland, Northern Territory, Tasmania and Victoria and together process some 1.8 million transactions annually.

The acquisition of CashMyATM will take the total number of operational Stargroup ATM’s to over 350 machines processing some 2.9 million transactions each year and current annualised revenue of greater than $7.5 million with that figure increasing via further organic growth to well over $11 million next financial year.

THE ACQUISITION

The CashmyATM network has been in operation for seven (7) years and the business assets to be acquired include 97 ATMs and site agreements, the CashmyATM brand, modems, a vehicle, mobile ATM trailer and ATM inventory. Existing CashmyATM liabilities, including for staff entitlements, do not form part of the acquisition.

No shareholder approval is required for the acquisition.

The acquisition is anticipated to complete in early July, with economic effect from 1 June 2016.

CONSIDERATION

Stargroup has agreed to pay $4.54 million with the consideration being paid as follows:

- $100,000 as a non-refundable deposit which was paid on 30 May 2016;

- $454,000 in STL shares on completion at an issue price of $0.05 and escrowed for a 12 month period; and

- $3,996,000 payable in cash on completion.

Also, but not forming part of the consideration, is the issue to Mr Warren of the following parcels of performance shares:

- 375,000 2016 Performance Shares

- 375,000 2017 Performance Shares; and

- 375,000 2018 Performance Shares.

The performance shares will be issued on the same terms as the classes of these performance shares presently on issue and held by former Stargroup director, Mr Zaffer Soemya. (See ASX release dated 15 June 2015)

To assist with the smooth completion of the transaction, Mr Soemya has agreed to cancel a corresponding number of his performance shares.

NO MATERIAL CONDITIONS PRECEDENT

Apart from that the warranties are to be true on completion, that the assets are to be encumbrance free and Mr Warren’s engagement as the National Business Development Manager, there are no material conditions precedent to the acquisition.

FUNDING

The cash components for the acquisition are intended to be funded as follows:

- the non-refundable deposit was paid out of Stargroup’s existing cash holdings;

- the completion cash payment will be funded from the proceeds of the completed private placement and a rights issue referred below.

The new Stargroup shares to be issued to CashmyATM on completion will be issued at an issue price of $0.05 per share.

No debt funding is needed to complete the acquisition. The Company has, however, successfully negotiated a $1.5 million debt facility for its use in future mergers and acquisitions, if needed.

CAPITAL RAISING

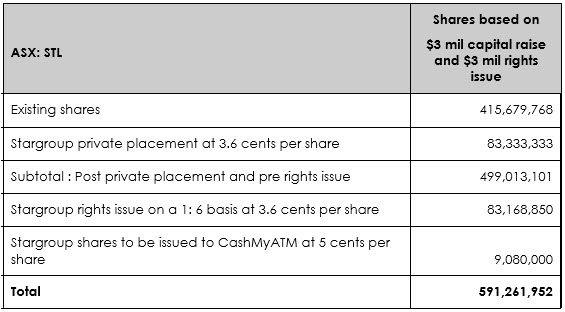

To in part fund the completion cash payment, Stargroup will raise $3 million in a private placement by the issue of 83,333,333 shares at 3.6 cents per share and will undertake a rights issue to existing Stargroup shareholders on a 1 for 6 basis at 3.6 cents per share, to raise a further $3 million.

The $3million private placement has already been completed and was managed by the Company’s Executive Chairman and Chief Executive Officer, Mr Todd Zani, with assistance from PAC Partners.

The Company has already had firm commitments from the shareholders that participated in the private placement to take up $1.6 million of the rights issue with the balance being expected to be subscribed by other Stargroup shareholders.

The rights issue will also be managed by the Company’s Executive Chairman and Chief Executive Officer. The Company will be paying a broker stamping fee of 4% in respect of rights taken up by its shareholders from whom commitments have not been received at the date of this announcement. The Company will also work closely with its Corporate Advisors to place any shortfall in the rights issue,.

EXPECTED IMPACT ON FINANCIAL POSITION

Stargroup’s expected capital structure on completion of the acquisition and raising is set out below:

Stargroup also expects that on completion, as if the acquisition were completed on 30 April 2016:

- that its projected net assets at the time of purchase will increase from $9,024,023 to $15,478,023;

- that its total shares on issue will be 591,261,952, an increase of 175,581,184.

- that its projected annualised revenue for the ATM network for the period 1 July 2016 to 30 June 2017 will increase from $9,303,000 to $11,400,421, and

- that its projected earnings before tax and extraordinary items (EBITDA) for the period 1 July 2016 to 30 June 2017 will increase from $3,397,493 to $4,259,245.

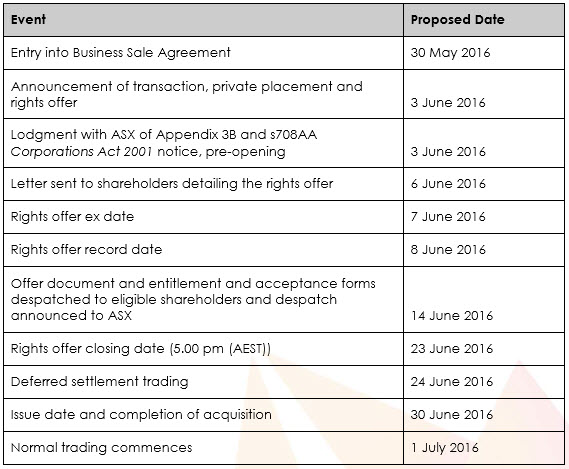

EXPECTED TIMETABLE

The above timetable is indicative only and may be subject to change, including in accordance with the requirements of the Corporations Act 2001 and the ASX Listing Rules.

VIEWS OF THE PARTIES

Mr Zani, Stargroup’s CEO and Executive Chairman said “Stargroup is excited to make another quality acquisition. We clearly outlined in our strategy that we would target smaller unlisted ATM deployers for value accretive mergers and acquisitions and this is a quality network to tuck into our operations.

Jason Warren is a very experienced ATM operator and I believe that this quality acquisition and his experience will bring further value to our shareholders in both the short and long term”.

Mr Jason Warren, owner and CEO of CashMyATM said “I am looking forward to working with Mr Zani and the team at Stargroup and continuing to add further quality sites to the network as part of the Stargroup vision to become the leading Australian ATM deployer.”

“I have always targeted quality ATM machine sites that are capable of rapid payback of capital deployed and I know Stargroup have this same level of discipline so our coming together is a good fit for both parties”, said Mr Warren.