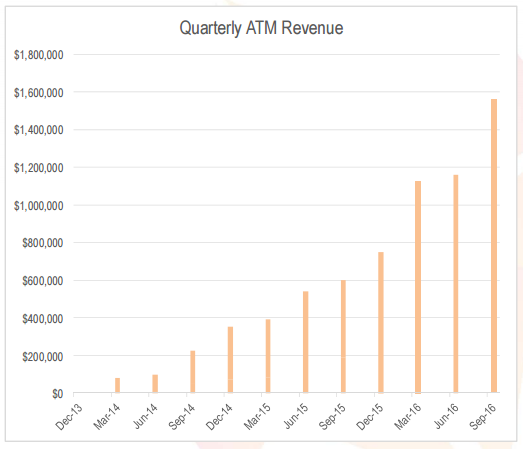

Financial technology company Stargroup Limited (ASX:STL) has delivered an 11th consecutive quarter of record revenue, beating previous projections made by the Company by 13%. Stargroup’s September quarter operational update showed a 51% increase in total revenue and a 35% increase in ATM revenue compared to the prior quarter. Monthly transactions per ATM, a key metric for the Company, averaged 630 across the three months to September 30, up from 614 in the June quarter.

HIGHLIGHTS

- 151% increase in quarterly revenue compared to prior year

- 93% increase in EFTPOS revenue compared to prior quarter

- 51% increase in total revenue compared to prior quarter

- 35% increase in ATM revenue compared to prior quarter

- 3% increase in the average number of active ATMs compared to prior quarter

- 2% increase on ATM transactions compared to prior quarter

Stargroup Limited (ASX:STL) (“Stargroup” or “the Company”) is pleased to announce that its ATM network has delivered another record quarter of revenue, the 11th in a row, a result that was well above previous projections.

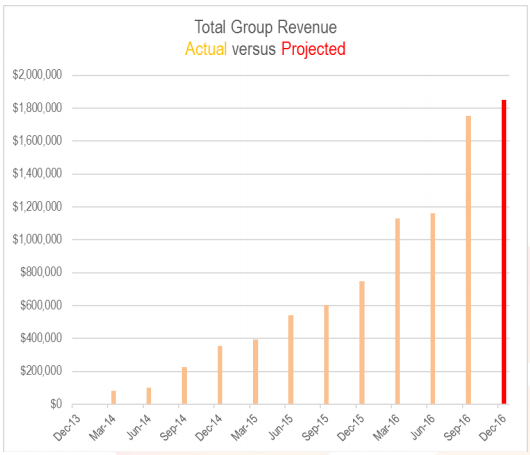

Todd Zani, Stargroup’s CEO and Executive Chairman, said: “Our total revenue for the quarter was up 51% on the prior quarter and our ATM revenue was up 35% on the prior quarter, in what was another excellent result for the Group. It was in fact 13% above our previous estimates to market.

“When you couple this with the fact that our transactions on our ATM network were up 2% on the previous quarter and our average number of transactions per machine per month, which is our key metric, was also up a further 3%, this if further proof that cash is still king to most Australians.

“We are still projecting further revenue increases next quarter based on our contracted sales and as a result, we are conservatively estimating that next quarter will see a 3% increase in group revenues, as highlighted below.”

Stargroup’s monthly transactions per ATM continue to be arguably the industry best, with the average for the last quarter being 630 transactions a month per machine (June quarter: 614).

“We are continuing to increase our key ATM metric and we are easily paying back our capital from each ATM within 15 months from purchase,” Mr Zani said.

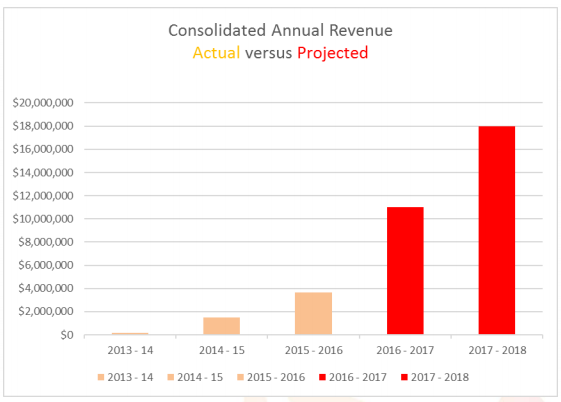

“We also saw our EFTPOS revenues increase by 93% in the last quarter and are looking forward to the certification of our new EFTPOS hardware and software in 2017 as part of the customization and certification of the recent announced technologies we are working on with West International AB. “Our business has grown considerably in the last 12 months and our annualized revenues in the last quarter were a 151% improvement on the prior year result. Our recently announced annual results showed that revenue from operations were up 521% on the prior year and we are projecting a further 300% growth in the 2017 financial year, as highlighted below.

“The 2016 financial year has truly been transformational for Stargroup and the future looks excellent. We have clearly laid out our strategy to become a leading financial technology player in the Australian market. The completion of the Indue acquisition, anticipated in December, is only going to add further value for shareholders in 2017 and beyond.”.