Sundance Resources (ASX: SDL) says it is confident of raising fresh funds after announcing a deal with noteholders that will leave the Perth-based, Africa-focused iron ore company debt free. Signing off on the June quarter, Sundance said it had kept expenditure to a minimum as it progressed the noteholder debt-to-equity deal, which was signed and announced after quarter end. The debt deal positions Sundance to advance its Mblama-Nabeba iron ore project.

Summary:

- Agreement reached for Sundance to be debt free following cancellation of Convertible Notes

- $418,000 on hand at 30 June 2018

Sundance Resources Limited (ASX: SDL) (“Sundance” or “Company”) provides the following information about activities for the quarter ended 30 June 2018:

AGREEMENT FOR SUNDANCE TO BE DEBT FREE FOLLOWING CANCELLATION OF CONVERTIBLE NOTES

On 30 July 2018 Sundance announced that the Company had reached agreement to restructure its balance sheet and eliminate the Convertible Notes (“Notes”) that were due to mature in September 2019.

On 29 July 2018 Sundance signed a legally binding term sheet with Senrigan Master Fund, Noble ResourcesInternational Pte Ltd, D. E. Shaw Composite HoldingsInternational, Ltd, Wafin Limited, BSOF Master Fund L.P. and David Porter (together the “Noteholders”) to, subject to certain conditions being satisfied or waived, cancel their Convertible Notes (“Notes”) in consideration for a combination of equity in Sundance and a capped production royalty (“Restructure”).

The redemption value of the Notes is $132.86 million. The Notes have a maturity date of 23 September 2019, by which time Sundance would have to repay them.

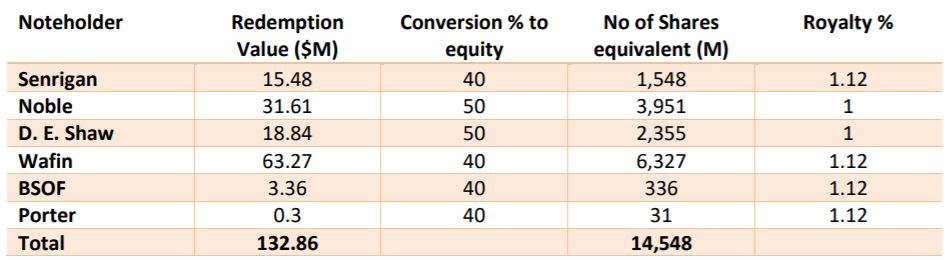

Under the agreed deal, each Noteholder was offered an opportunity to cancel its Notes in exchange for such number of shares in Sundance that represents between 30 – 50% of the redemption value of its Notes, based on a Sundance share price of 0.4 cents. The level of equity that a Noteholder elected to receive determined the rate of the proposed production royalty, which ranged from 1.00% to 1.24% of their share of revenue from the sale of the first 517 million tonnes of ore from the Project. The calculation of value to the Noteholders was determined by reference to the long term iron ore price of US$69/t CFR China. The royalty payable to the individual Noteholders will be calculated as follows:

Royalty = QR x NP x RR

where:

QR is the revenue received by Cam Iron and/or Congo Iron from ore sales from the Project for the relevant quarter.

NP is the Noteholder’s Redemption Value of the Notes it holds as a proportion to the total Redemption Value of Notes on issue, in each case immediately prior to the Restructure.

RR is the applicable Royalty Rate agreed as described in the table below.

The detail of the proposed conversion is covered in the table below:

Sundance has approximately 19,000 shareholders. Following completion of the Restructure, the Top 20 shareholders (including the Noteholders) will own 80% of the shares on issue. Currently, the Top 20 shareholders own 44% of the shares on issue.