December quarterlies are published, applications for the 2023 Diggers & Dealers Mining Forum in train and the calendar has tipped over to February – investors are back to look at opportunities for the year ahead.

They are doing so in a world of inflation (wait for an inevitable further interest rate rise on Tuesday), labour shortages, threat of a global recession and geopolitical headwinds that is even – at times – undermining the battery metals thematic.

At least gold is ticking up again, which is music not just to the ears of investors in Gold Road Resources (ASX: GOR) and industry leader Northern Star Resources (ASX: NST).

Seasoned investors know that uncertain times present a buyer’s market and there are plenty of well-led companies with strong momentum at this early stage of the year.

Core Lithium (ASX: CXO) is mining and crushing ore at Finniss, near Darwin in the Northern Territory, and a month ago shipped a maiden 15,000dmt cargo of lithium DSO to China.

The Gareth Manderson-run company is preparing for commissioning of the spodumene concentrate plant ahead of maiden production of the 6 per cent lithium product so desired by players in the battery sector.

In parallel to project completion, Core will spend $25 million this calendar year on exploration – almost double last year’s tally – to grow Finniss’ resource and reserve base past its 12-year mine life.

Core drilled continuously throughout 2022 and a backlog of high-grade drilling results from the BP33, Hang Gong, Far West and Bilatos deposits have investors champing at the bit in anticipation of the next resource and reserve update.

Like Core, St George Mining (ASX: SGQ) has spelt out an active lithium exploration program at its flagship Mt Alexander project, in WA’s Goldfields.

Field work got underway last month and drilling of lithium targets across the fast-expanding Jailbreak prospect should resume within weeks.

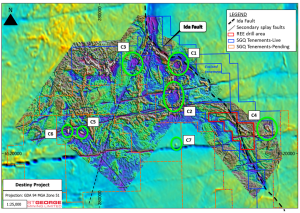

Late last year, St George executive chairman John Prineas moved to significantly increase its landholding along the Mt Ida Fault to a near-continuous coverage of more than 15km of the highly prospective pegmatite corridor that runs parallel to the Copperfield Granite.

With more than $6 million cash at December 31 and rigs being mobilised, St George has primed investors for significant news flow.

Another junior that is off to a fast start in 2023 is Rox Resources (ASX: RXL).

The Rob Ryan-run Perth company closed out 2022 with $10.5 million cash and equivalents and last month kicked off a program comprising 16,000m of reverse circulation and 7,000m of diamond drilling focused on converting inferred resources at its flagship Youanmi gold project near Mt Magnet to the indicated category.

Priority targets of the drilling are the Link and Kathleen deposits, with any increase in resource numbers to feed into upcoming feasibility studies into a mining start-up at Youanmi.

A Youanmi scoping study finished last year targeted high-grade, low-cost ounces of the 3.2Moz resource through the production of gold-in-concentrate and carbon-in-leach bullion production. The scoping study projected an average annual gold production of about 71,000oz, with an average head grade of 5g/ gold, for a total output of 569,000oz over an eight-year mine life.

“We expect to continue to improve the financial metrics and the production target as we continue to drill out and increase the geological confidence in the gold resource,” Mr Ryan told investors.

“Drilling has commenced at Youanmi targeting the conversion of inferred resources to the higher confidence indicated category while also looking to test the exciting Midway discovery.

“With drilling underway and feasibility studies advancing, investors can look forward to consistent news flow in 2023 as we look to improve the current resource and project metrics.”

Finally, shareholders in Perth Basin junior Norwest Energy (ASX: NWE) are increasingly grasping the value proposition of takeover suitor Mineral Resources’ (ASX: MIN) one-for-1300 scrip offer.

The offer has the unanimous support of the Norwest board, with the target’s directors pledging to exchange their shares for MinRes scrip.

By late last week, MinRes had secured 25.5 per cent of the target – Norwest is the junior partner in MinRes’ Lockyer Deep conventional gas discovery – ahead of the scheduled offer close on February 20.

Expect Norwest acceptance updates to add to what is shaping as a busy calendar of news flow from companies smart enough to waste no time in getting going in 2023.